Liebe Leserinnen und Leser,

Die neue Virusvariante Omikron befeuert Pandemieängste und Jerome Powell hat gestern Abend vor dem US-Kongress einen schnelleren Ausstieg aus der ultralockeren Geldpolitik in Aussicht gestellt. Ein Newscocktail, der zu deutlichen Kursreaktionen führte. Nichtsdestotrotz konnte der Technologie-Index Nasdaq 100, auf Monatssicht um 2% zulegen, der deutsche Leitindex DAX hingegen verliert auf Monatssicht mehr als 5%. Unser mit Technologieleadern bestückter AI Global Opportunity Fonds kann auf Monatssicht 3% zulegen. Unser Alpha AI US leveraged Zertifikat um starke 4%.

Die Nachrichtenlage rund um die Pandemie wird uns diesen Winter noch einige turbulente Tage bescheren. Auch die Überwachung der FED Geldmenge muss mit Argusaugen durchgeführt werden. Vorhersagen zum Pandemiegeschehen werden und können wir mit unserer AI CAESAR nicht treffen. Die Überwachung von makroökonomischen Zahlen, insbesondere der monetären Situation der Notenbanken ist hingegen unsere Paradedisziplin.

Der Dezember wird unserer Meinung nach weiterhin ein zweigeteiltes Bild zeigen. Virusangst trifft auf sich verbessernde Fundamentaldaten sowie immer noch expansiven Notenbanken, auch wenn sich die Rhetorik von Jerome Powell verändert. Wie sich dies im Detail darstellt, lesen Sie im Ausblick Dezember.

Ausblick Dezember „Omikron und Jerome“

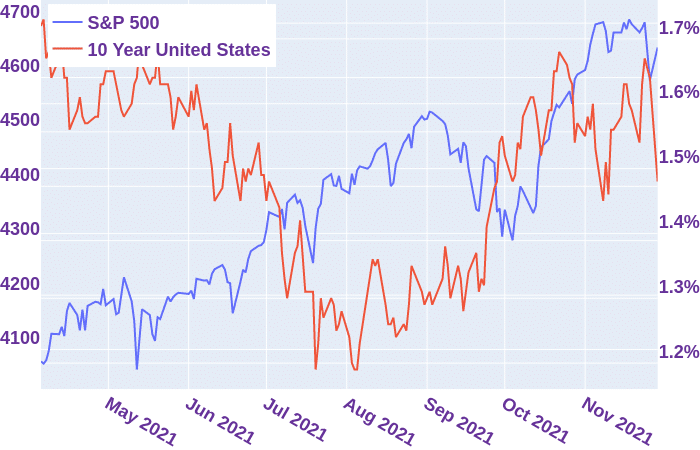

Für den abgelaufenen Monat hatten wir die durchschnittlichen Marktrenditen des statistisch guten Börsenmonat November erwartet. Trotz Omikron Verwerfungen sind diese Renditen im Techbereich eingetreten. Die nackte Sicht auf die Datenlage zeigt, dass die erneute Flucht in sicherere Anlageklassen wie Anleihen nun das Aktiensentiment wieder ein Stück weit attraktiver gemacht hat. Die Mehrzahl der überwachten Indikatoren wie Realzins oder FED Geldmenge liegen weiter komfortabel im grünen Bereich. Gerade die Rendite der 10-jährigen US-Staatsanleihe (Chart 1: US 10 Year Treasury vs. S&P 500) ist auf aktuell sehr niedrige 1,40% gefallen.

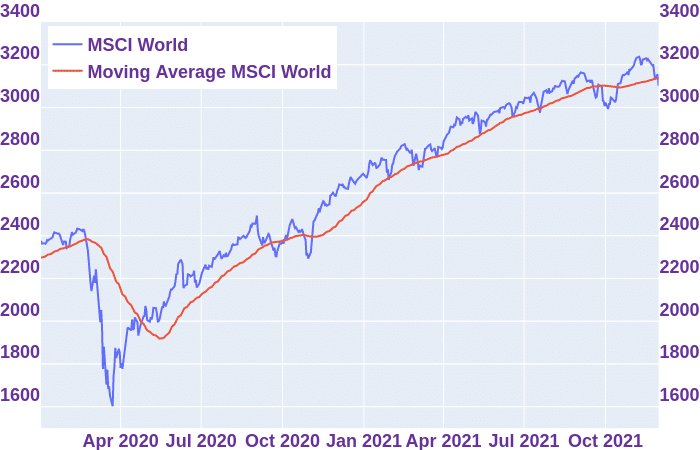

Unser System trackt unter anderem auch den MSCI World Index, der alle wichtigen Weltregionen abdeckt. Der Index notiert aktuell wieder unter dem mittelfristigen Durchschnitt und zeigt damit, dass Stress im Markt ist und der stabile Aufwärtstrend der letzten Wochen erstmal unterbrochen wurde und mit weiteren volatilen Tagen zu rechnen ist. (Chart 2: MSCI World Index ).

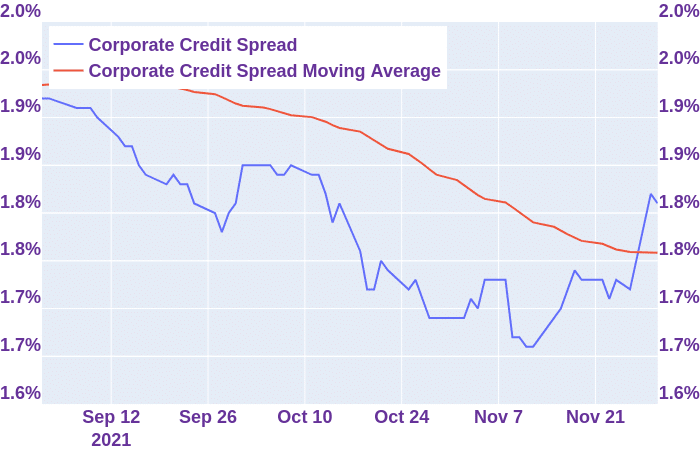

Eine negative Tendenz bildet aktuell der Spread von BAA Unternehmensanleihen zur 10 jährigen US Staatsanleihe aus (Chart 3: BBA Corporate Bonds vs. 10y US Treasury). Seit Ende November ist ein deutlicher Anstieg eingetreten, der ebenfalls als Risikosignal zu werten ist.

Auch unser auf Marktrisikoindikatoren optimiertes Frühwarnsystem zeigt zum Start in den Dezember hohes Risiko an. Wir verzichten in diesem sehr nervösen Umfeld auf Leverage in all unseren Strategien.

Fazit:

Unsere übergeordnete Markteinschätzung bleibt unverändert bullish. Viele Riskioindikatoren zeigen aber aktuell den von Omikron ausgelösten Stress im Markt deutlich an.

Mit unserem Titel Omikron & Jerome wollen wir auf die beiden aktuellen wichtigsten Einflussgrößen aufmerksam machen, die den Markt hin und herbewegen: Angst vor dem Virus und die doch wieder tiefen Zinsen.

Für unsere Private Alpha Anlageexperten, die über jahrzehntelange Erfahrung im Private Banking verfügen, ist das Pendel wieder zu sehr auf die ängstliche Seite ausgeschlagen. Fundamentale Daten sowie Saisonalität sprechen für steigende Kurse bis zum Jahresende. Sollte sich die neue Virusvariante als nicht so gefährlich wie die bereits bestehende Delta-Variante herausstellen, ist mit steigenden Kursen zu rechnen. Auch die Rhetorik des FED Chef Jerome Powell sollte noch nicht überinterpretiert werden. Noch ist mit üppiger Liquiditätszufuhr zu rechen.

Wir behalten daher in all unseren Strategien eine übergewichtete Investmentquote bei und werden in unseren chancenorientierten Anlagestrategien auch wieder Leverage aufbauen, sobald unser hoch agiles Risikomanagementsystem das von CAESAR überwacht wird, grünes Licht gibt.

Leading Indicators:

Die Indikatoren werden von CAESAR benutzt, um eine ideale Investmentquote sowie Risikoanalysen für die globalen Aktienmärkte zu definieren.

Chart 1: 10 Year US-Treasury

Fazit: Der 10-Jahreszins der US-Staatsanleihe ist ein wichtiger Indikator für den S&P 500 und den Nasdaq. Der deutliche Rückgang ist positiv für Aktien einzustufen. Zum Start in den Dezember liegt das Zinsniveau bei 1.42%. Technologieaktien profitieren primär von diesem weiterhin sehr günstigen Zinsumfeld.

Chart 2: MSCI World Index

Fazit: Der Moving Average auf dem MSCI World Index ist ein wichtiger Indikator, der die technische Lage im Markt anzeigt. Dieser Indikator zeigt, dass die Bären aktuell das Ruder in der Hand halten, da der Indikator unter den Aufwärtstrend gefallen ist.

Chart 3: Bond Spreads

Fazit: Der Bondspread zwischen US Unternehmensanleihen und US Staatsanleihen ist ein guter Gradmesser für den Stresslevel, der sich im Kapitalmarkt befindet. Der deutliche Anstieg zeigt, dass Anleger den sicheren Hafen der US Staatsanleihen gegenüber risikoreicheren Anlageklassen bevorzugen.

Marktrisiko: Das von CAESAR täglich gemessene Marktrisiko für eine deutliche Korrektur ist hoch. Grundlagen dieser Analyse sind von CAESAR ausgewertete untereinander unabhängige Risikoindikatoren. Aus Risikosicht sollte derzeit mit volatilitätsoptimierten Investmentquoten investiert werden und auf Leverage verzichtet werden.

Produkteupdate:

Unser AI Global Opportunity Fund konnte im November erneut den Markt schlagen. Auf Monatssicht erreichten wir 3,0% Rendite und schlagen somit den Benchmarkindex Nasdaq100 um ein Prozent. Die Top-Performer der vergangenen vier Wochen befinden sich alle hoch gewichtet in unserem Portfolio: Qualcomm +32%, AMD +30%, Nvidia +24%; Xilinx +23% und DollarTree+22%.

Unser Portfolio ist bestückt mit Digitalisierungsgewinnern. Die sich wieder verschärfende Pandemie und der fallende Realzins sollte den Digitalisierungstrend bis zum Jahresende weiter beschleunigen. Wir setzen darauf.

Alpha AI US leveraged Zertifikat:

Das Alpha AI US leveraged Zertifikat konnte im Oktober um 4% zulegen. Seit Start vor vier Monaten liegen wir nun 16% im Gewinn, wo hingegen der S&P 500 nur um 7% zulegen konnte. Im November konnte das Zertifikat über mehrere Wochen am starken Kursanstieg überproportional mit 200% partizipieren und so das deutliche Alpha zur Benchmark aufbauen. Ende November wurde das AI gesteuerte Risikomanagement aktiv und hat die Investmentquote auf 100% zurückgeführt. Für chancenorientierte Anleger ist dieses neue Zertifikat eine renditestarke Depotbeimischung.

„Neu“ Alpha AI Innovation Leaders Zertifikat

Zum Jahresendspurt wollen wir Ihnen noch unsere aktuellste Neuemission vorstellen: das Alpha AI Innovation Leaders Zertifikat. Das Zertifikat ist ein smarter Indextracker auf einen Basket von 25 Innovation Leadern aus den Bereichen Internet 4.0, Blockchain, Biotechnologie, Robotik & Green Tech Innovationen. Unser Private Alpha Stock Screener selektiert aus einem Universum von 250 Innovationsleadern monatlich die 25 stärksten Firmen. Das Zertifikat soll in guten Marktphasen die volle Partizipation an den innovativsten Firmen der Welt bieten, aber gleichzeitig auch zusätzlichen Schutz bei Marktkorrekturen durch die AI Absicherung gewährleisten. Das Marktexposure kann zwischen 0% bis 100% schwanken. Seit Emission Anfang Oktober konnte die Strategie um +7% zulegen.

Alle unsere Strategien liegen auf Jahressicht deutlich in der Gewinnzone!

Performance Update:

| Name | 1M | YTD | 1Y |

| AI Global Opportunity, $ | +3% | +13,5% | +18,0% |

| DE000A2JQKU8 | |||

| Alpha AI Sustainable, € | +1,3% | +14,5% | +20,0% |

| DE000LS9QPW3 | |||

| Alpha AI US 500, € | +3,5% | +25,5% | +26% |

| DE000LS9QPV5 | |||

| Alpha AI US Tec 100, € | +4,0% | +28,1% | +31,0% |

| DE000LS9QQJ8 | |||

| AI Swiss Index, CHF | +0,3% | +8,8% | +14,3% |

| CH0489814233 | |||

| AI Swiss Index, € | +0,3% | +8,9% | +14,8% |

| DE000VE2UH16 | |||

| Alpha AI US Leverage, € | +4,0% | +11,5% | n/a |

| DE000VE2UH16 | |||

| Alpha AI Innovation, € | -1,0% | +7,5% | n/a |

| DE000LS9SMJ3 |

Stand 01.11.2021

Wir wünschen Ihnen einen gesunden Start in den Advent.

Ihr Private Alpha Team

Überzeugen wir Sie mit unseren Analysen. Hier kostenlos zum monatlichen Update anmelden, um zukünftig kein Update mehr zu verpassen. –> Research anmelden

Social Media